Raise. Close. Report.

Fundraising is a cycle — which means as one thing ends another begins. Venture360 is the only tool you will ever need to support the entire fundraising cycle.

Build your deal room

Because we have serviced investors for years, we know what they are looking for and how they like information presented. Our deal rooms help you organize the information about your company in a way that allows potential investors to get to the point of what you are trying to do quickly.

The faster an investor can get to a “yes” or “no,” the more effective your capital raise will be.

Find Investors

With Venture360, you will have three options for how you market your deal to investors. Because you control who, what, how and when—we are not a crowdfunding portal but a marketing portal. It is up to you to adhere to the rules and regulations around selling securities. You also aren't limited to investors on Venture360. Here are all the ways you can connect and engage with investors using our product while also leveraging visibility on any other funding website:

Public Profile

Make your profile visible to Venture360 users —thousands of VC, angel groups, and family offices.

Website Registration

Venture360 provides a unique link to place on your website for investors to register.

Database Access

Search our database of 5,000+ VCs and angels for those who invest in your deal type

Direct Invitations

Directly invite prospective investors into your deal room.

Close the Round

How you organize your closing can mean the difference between getting money next week or next year—no exaggeration. You need to move quickly and efficiently before people lose interest and move onto the next deal. With Venture360, you are just three steps away from closing your round.

Issue Documents

Using Venture360's esignature integration.

Send Capital Calls

Request funds and collect payments.

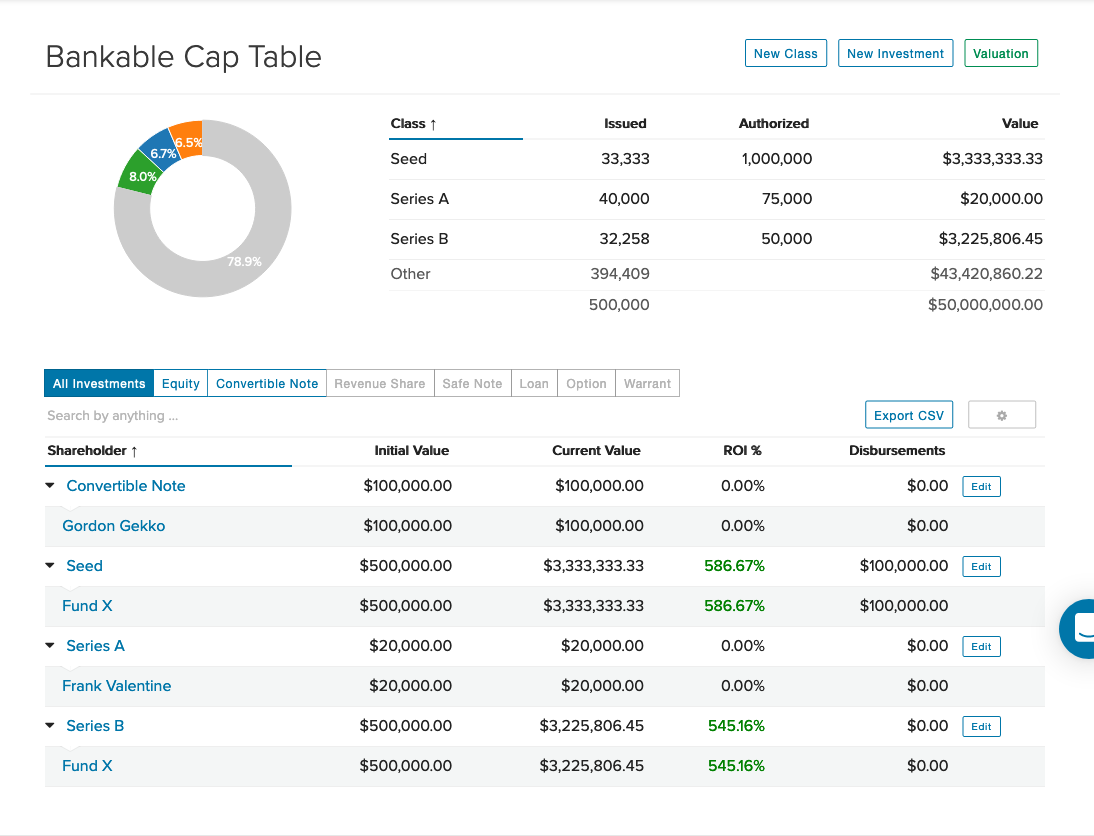

Close to Cap Table

Cap table is seamlessly updated.

Investor Reporting

You cashed your first check, so you're done raising money, right? Not exactly. How you handle reporting to your investors will determine how likely you will be to raise the next round, and trust us, you will probably need another round.

The easiest way to raise your next round is from current investors. Current investors want to be kept up to date before investing again. Venture360 makes reporting everything from financials to custom metrics incredibly easy. Providing this information in a timely manner helps your investors feel engaged in your business progress, shows your commitment to be a good steward of their money, and makes them more likely to continue to support the business in follow-on rounds.

Get started for free

See Venture360 in action

Our team walks you through all major Venture360 features you'll need to power your business in this video.

Why Venture360

At Venture360 we understand entrepreneurs because we are entrepreneurs. We know you have a business to run and a dream to chase, so we built Venture360 to lighten the administrative and regulatory burdens that come with raising capital. From attracting investors to reporting, let us simplify managing your private capital for you.

Get started for free